IRRAS AB (“IRRAS” or the “Company”) (Nasdaq First North Premier: IRRAS) today announces that the Company has successfully completed a directed share issue of approximately SEK 106 million.

The Board of Directors of IRRAS has, based on the issue authorization granted by the Annual General Meeting held on 14 May 2019, and as indicated in the Company’s press release on 22 May 2019, resolved on a directed share issue of 4,800,000 new shares at a subscription price of SEK 22 per share (the “Issue”), which means that the Company will receive gross proceeds of approximately SEK 106 million. The subscription price in the Issue has been determined through an accelerated bookbuild procedure. Subscribers in the Issue are a number of Swedish and International institutional investors.

The proceeds from the Issue will support IRRAS’ ongoing launch of IRRAflow in the United States and globally, including the EU pending CE Mark recertification. This will also allow IRRAS to build up its product inventory and ramp up its sales and marketing activities. As a result of the Issue, IRRAS is capitalized until Q3/Q4 2020.

The Issue entails a dilution of approximately 20 percent of the number of shares and votes in the company. Through the share issue, the number of outstanding shares and votes increases by 4,800,000 from 24,017,974 to 28,817,974. The share capital increases by SEK 144,000 from SEK 720,539 to SEK 864,539.

The reasons for deviation from the shareholders’ pre-emptive rights are to raise capital in a time-efficient and cost-efficient manner and to diversify the shareholder base with additional institutional investors.

In connection with the Issue, the Company has agreed to a lock-up undertaking, with customary exceptions, on future share issuances for a period of 180 calendar days after the settlement date. In addition, larger shareholders[1] have undertaken not to sell any shares IRRAS for a period of six months following the resolution to issue the new shares in the Issue, subject to customary exceptions.

“We are very pleased to welcome new shareholders. Attracting high-quality and long-term investors demonstrates the strength of our commercial product portfolio and our ability to execute on our corporate goals,” said Kleanthis G. Xanthopoulos, Ph.D., President and CEO of IRRAS. “There is a large market for intracranial procedures and the proceeds from this share issue provide funding to help make IRRAflow a potential first-line treatment for intracranial fluid drainage.”

Carnegie Investment Bank acted as sole Global Coordinator and Joint Bookrunner and Pareto Securities acted as Joint Bookrunner in connection with the transaction. Setterwalls Advokatbyrå acted as legal advisor.

For more information, please contact:

US

Kleanthis G. Xanthopoulos, Ph.D.

President & CEO

info@irras.com

Europe

Fredrik Alpsten

CFO and Deputy CEO

+46 706 67 31 06

fredrik.alpsten@irras.com

This document is considered information that IRRAS is obliged to disclose pursuant to the EU Market Abuse Regulation. The information was released for public disclosure, through the agency of the contact person above, on May 22, 2019 at 22.30 pm (CET).

About IRRAS

IRRAS AB (Nasdaq First North Premier: IRRAS) is a publicly-traded, commercial-stage medical technology company focused on developing and commercializing innovative solutions for brain surgery.

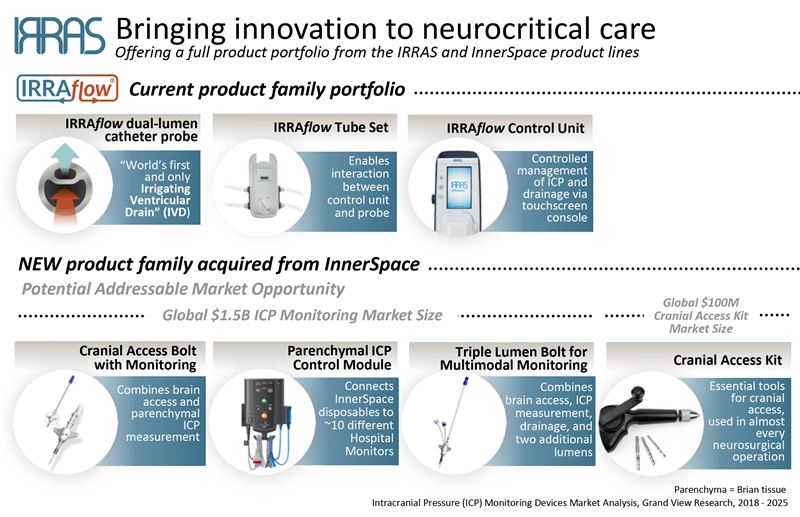

The company’s initial product, IRRAflow®, is the world’s first “irrigating ventricular drain.” Its unique mechanism of action addresses the complications associated with the current methods of managing intracranial fluid by using a dual lumen catheter that combines active irrigation with ongoing fluid drainage. Additionally, IRRAflow incorporates ICP monitoring and uses a proprietary software to regulate treatment based on desired pressure levels. IRRAflow received FDA-clearance in July 2018. IRRAflow received FDA clearance in July 2018.

With its unique product portfolio, protected by property patents and patent applications, IRRAS is well positioned to establish a leadership position in the medical device market. IRRAS maintains its headquarters in Stockholm, Sweden, with corporate offices in Munich, Germany, and San Diego, California, USA. For more information, please visit www.irras.com.

IRRAS AB (publ) is listed on Nasdaq First North Premier. Wildeco is certified adviser of the company. Wildeco is reached at + 46 8 545 271 00, or at info@wildeco.se.

Important Information

The release, announcement or distribution of this press release may, in certain jurisdictions, be subject to restrictions. The recipients of this press release in jurisdictions where this press release has been published or distributed shall inform themselves of and follow such restrictions. The recipient of this press release is responsible for using this press release, and the information contained herein, in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer, or a solicitation of any offer, to buy or subscribe for any securities in the Company in any jurisdiction where such offer would be considered illegal. This press release does not constitute an offer to sell or an offer to buy or subscribe for shares issued by the Company in any jurisdiction where such offer or invitation would be illegal. In a member state within the European Economic Area (“EEA”) that has implemented Directive 2003/71/EC (together with applicable implementation measures in any member state, the “Prospectus Directive”), shares referred to in the press release may only be offered (a) to a qualified investor as defined in the Prospectus Directive; or (b) in any other respect in accordance with Article 3(2) of the Prospectus Directive.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public offering of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the United States, Canada, Japan, South Africa or Australia, or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, “qualified investors” who are (i) persons having professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

This press release is not a prospectus for the purposes of Prospectus Directive and has not been approved by any regulatory authority in any jurisdiction. IRRAS has not authorized any offer to the public of shares or rights in any member state of the EEA and no prospectus has been or will be prepared in connection with the Issue. In any EEA Member State, this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the Prospectus Directive. This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the new shares. Any investment decision in connection with the Issue must be made on the basis of all publicly available information relating to the Company and the Company’s shares. Such information has not been independently verified by the Joint Bookrunners. The Joint Bookrunners are acting for the Company in connection with the transaction and no one else and will not be responsible to anyone other than the Company for providing the protections afforded to its clients nor for giving advice in relation to the transaction or any other matter referred to herein.

Information to distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares in IRRAS have been subject to a product approval process, which has determined that such shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, Distributors should note that: the price of the shares in IRRAS may decline and investors could lose all or part of their investment; the shares in IRRAS offer no guaranteed income and no capital protection; and an investment in the shares in IRRAS is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Issue.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares in IRRAS.

Each distributor is responsible for undertaking its own target market assessment in respect of the shares in IRRAS and determining appropriate distribution channels.

[1] Lexington Holdings Assets Limited (BVI), Bacara Holdings Limited, F.EX Endotherapy Limited, Anders P. Wiklund, Kleanthis G. Xanthopoulos and Fredrik Alpsten.